Have it your way with a will

A will is a legal document that determines how and on which terms your inheritance is to be distributed. If you would like an alternate distribution of inheritance than the one presented in the Danish Inheritance Act, you ought to draw up a will. If you have beneficiaries entitled to an indefeasible portion of your estate under the Danish inheritance law (spouse or heirs of the body), you can however only control ¾ of what you leave (portion available for testamentary freedom). The remaining ¼ is the legitimate portion.

You should consider drawing up a will if:

- You are not married but have a domestic partner who you would like to secure financially.

- You have children from a previous marriage who are to inherit differently than what the Danish Inheritance Act prescribes.

- You do not leave any children, spouse or domestic partner, or if you want to include children-in-law, ex-spouse, cousins or a specific association or organisation.

- You wish to ensure your spouse the financial possibility of deciding whether he or she wishes to retain undivided possession of the estate in the event of your death.

- You wish to settle the inheritance for your beneficiaries (relevant if you have minor children or large property). The legitimate portion may only be settled until the age of 25, while the portion available for testamentary freedom may in principle be settled for as long as desired.

- You want the inheritance to belong to the recipient as separate property. This is for instance to ensure that your children will not be liable to share any inheritance from you with a potential spouse in case of separation/divorce or in the event of death. You may choose which type of separate property the inheritance is to be.

How to draw up a will

There are two types of will, and it may be a good idea to consult a legal adviser when drawing up a will.

Will attested by a notary

• The will must be signed in front of a notary (court official). The notary confirms that you are who you say you are, and that you are of sound and disposing mind and memory. It is therefore difficult to contest the validity of a will drawn up and signed before a notary.

• The will will be recorded in a central register, which ensures that it will automatically be disclosed upon death.

• The court fee for a will drawn up and signed before a notary is DKK 300.

• You may contact a city court in Denmark at your option. Learn more at domstol.dk.

Will attested by witnesses

• The will must be signed by two attesting witnesses. The witnesses must be independent (meaning that they cannot have a financial interest in the will).

• Risk: a will attested by witnesses is not registered with a court, and it is easier to contest the validity.

• Amendment or termination of a will must be done in the same way as it was drawn up. You do not need to draw up a will to decide who is to inherit standard household effects. You simply need to write it on a piece of paper, which you date and sign.

How much can you decide with a will?

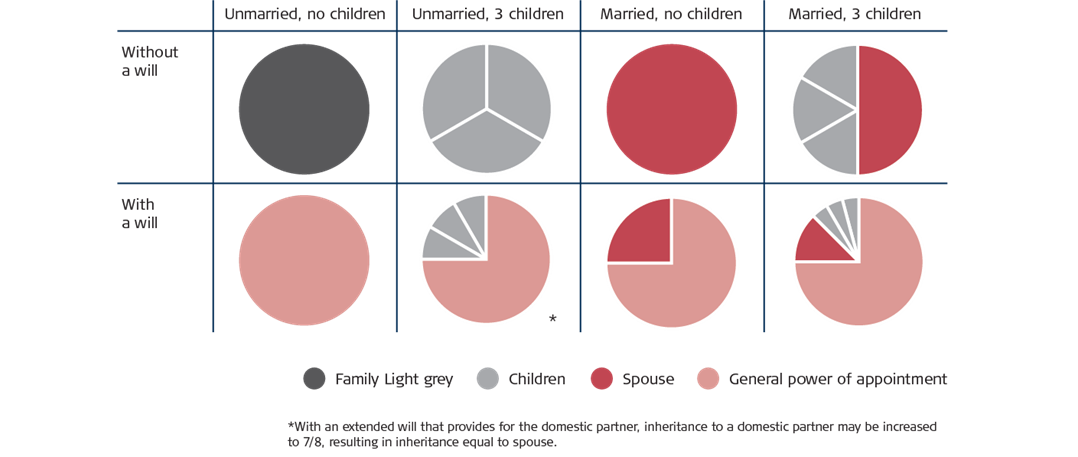

Below, you can find out who will inherit if there is no will, and how much of the estate you can dispose of in a will: