PFA achieved strong returns for customers and significant growth in results

In the first six months of the year, PFA's customers received attractive returns at the top of the commercial pen-sion market, and the customer community continued to grow significantly with a large influx of new customers and strong growth in payments. PFA's bottom line has improved significantly, and despite major challenges in societal health, the insurance business continues to make significant progress and is on track to being balanced.

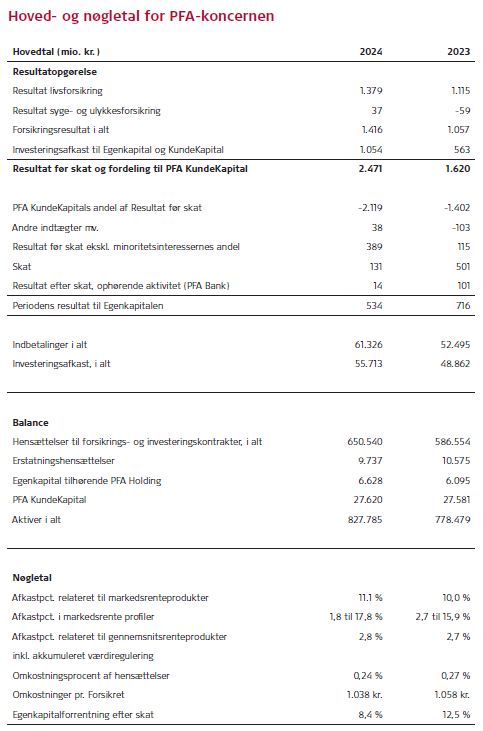

In the first half of the year, PFA had a profit before tax and profit sharing with customers of DKK 1,336 million compared to DKK 347 million in the same period in 2023.

The large increase in profit is mainly due to better investment results as well as improved underlying operations in the insurance sector and a large influx of customers in recent years.

"The first six months of the year have been good financially for our customers and in turn, good for PFA. Our customers have received one of the best returns among all pension companies over the past three years, and we are satisfied with this as it provides our cus-tomers with financial security. I also note that the customer community continues to grow significantly, and we are again setting records when it comes to payments and net addition of customers. We are pleased that our existing customers want to stay with PFA and that we can continue to attract many new customers," says Ole Krogh Petersen, Group CEO of PFA.

"We also see great progress in the field of health and accident insurance, which is on track to being balanced. This all adds up to a significantly improved bottom line, and since PFA is a customer community, our great progress benefits customers both financially and through our efforts to reduce long-term sickness absence. Overall, we are therefore very satisfied with the first six months of the year," says Ole Krogh Petersen, Group CEO of PFA.

PFA’s profits benefits customers in the form of profit-sharing via PFA’s CustomerCapital. In the spring, PFA again paid out DKK 1.7 billion to customers in interest on individual CustomerCapital for 2023. And with PFA's new model for CustomerCapital, which came into effect on 1 January 2024, customers can expect even higher returns from CustomerCapital for 2024, as it is expected that the interest will increase from 8 to 10 per cent.

Milestone reached with more customers and record high payments

In the first six months of the year, PFA saw significant growth in customer payments compared to the same period in 2023.

Total payments added up to DKK 29.6 billion compared to DKK 26.3 billion in the same period last year. This is a growth of 12.4 per cent, and the payments are the highest PFA has ever seen in a half year period.

Such growth is due to an increase in regular payments of 8.5 per cent from DKK 14.9 billion in the first half of 2023 to DKK 16.1 billion in the first half of 2024. In addition, single payments increased by 17.4 per cent from DKK 11.5 billion to DKK 13.5 billion during the period. The influx of new customers and good investment results led to customer funds increasing by DKK 65 billion from DKK 583 billion after the first half of 2023 to DKK 648 billion after six months of 2024. In the first six months of the year alone, customer funds grew by DKK 34 billion.

In the first six months of 2024, PFA had a net addition of 567 corporate and organisational customers. This is an increase of 17 per cent compared to the same period last year, when the number was 485.

“It's a great vote of confidence that we are experiencing a large influx of customers year after year. We are proud that so many customers choose to join PFA’s customer community. The high growth in payments and the large net addition of new customers shows that we have a really strong position in the market with good overall value offers for customers. The cornerstones of our value offers are financial security, good healthcare and senior solutions, and social responsibility, which are also areas that are in demand among our 1.3 million customers and thus in society. These are also the areas we will focus on and further improve in the coming years,” says Ole Krogh Petersen.

Health and accident insurance is close to being balanced

In connection with the new Danish executive order on health and accident insurance, PFA has, since 1 January 2022, rewritten occu-pational capacity insurance cover under life insurance instead of under health and accident insurance. Overall, the current operating result of this type of insurance totalled DKK -353 million. This is a significant improvement of DKK 157 million compared to the first half of 2023. Here, the result was a loss of DKK 510 million. The improvement should be seen in light of the fact that PFA, like the rest of the pension industry, is unfortunately experiencing an increase in the number of new long-term sickness absences, especially in the area of mental health. Despite this, PFA is following the recovery plan for health and accident insurance and still expects to be in balance during 2025.

The large growth in health and accident insurance in recent years is due to three main factors.

Firstly, PFA continues to help more customers to avoid long-term illness. In the first six months of the year, PFA's healthcare profes-sionals communicated with customers approximately 167,000 times, an increase from approximately 158,000 calls in the same period last year.

In addition, customers are making much greater use of the ability to get quick help online. In the first six months of the year, custom-ers contacted PFA Health Insurance online 25,860 times for help with physical and mental health challenges. This is an increase of 74 per cent compared to the same period last year.

At the same time, in the first six months of the year, PFA helped approximately 75,000 children and adults with treatment pro-grammes aimed at preventing long-term illness. This is an increase of 14 per cent compared to the same period last year. The devel-opment is mainly driven by the fact that more customers have needed help and advice for mental health issues or physical injuries, as well as the fact that PFA has increased its proactive efforts towards our customers and their health.

Secondly, PFA focuses on helping those suffering from long-term illness return to the labour market, with 789 customers returning in the first six months of the year. Overall, PFA has helped 7 per cent more customers return to the labour market compared to the same period last year, when 738 customers were reported fit for work.

Thirdly, insurance prices have become more balanced.

Combined, these efforts have led to a significant financial improvement on the bottom line and have also helped many customers.

“We can see that our efforts to offer customers fast and correct help are having an effect. We try to prevent long-term illness by proactively contacting customers in need of help using artificial intelligence, among other things. In this way, we are helping more customers remain fit for work and in good health,” says Ole Krogh Petersen.

PFA's efforts using artificial intelligence have proven to minimise the risk of long-term illness among selected customers by around 70 per cent, and PFA has won several awards – including the main prize at the Finance Impact ESG Awards 2024.

In addition to artificial intelligence, PFA has also recently strengthened its digital solutions for the company's customers.

“There's no doubt that people in Denmark are facing major health challenges and that we must constantly develop the help and services we provide to our customers. That's why we have also launched new online healthcare services, so our customers can now make use of online doctor, physiotherapy, psychologist, family therapist and coach. We expect this to mean that our customers can get help even earlier in the potential course of their illness, minimising the risk of it turning into a long-term illness.”

In isolation, the result of the remaining health and accident insurance in the first half of 2024 was DKK 44 million. If the health and accident insurance result had been calculated before a portion was transferred to the life insurance side of the business from 2022, the result in the first half of 2024 would have been DKK -250 million.

Significant growth in customers’ pension savings

A typical customer with 15 years to retirement in PFA's recommended profile C in the market rate environment can be pleased with a return of 9.3 per cent in the first six months of the year. This ranks at the top of the commercial pension market. Over the past three years, PFA's returns have been among the best of all pension companies, and over the past 10 years, a typical customer has received a return of 94 per cent.

The large US tech giants in particular have contributed to the positive development in returns in the first half of the year. In addition, Danish equities have contributed to the good return results, as PFA's customers have received a return of 27.4 per cent, which clearly outperforms the Danish C25 index, which grew by 7 per cent in the same period.

“For more than three years now, PFA customers have received one of the best returns on the market, and we are very satisfied with this as it provides financial security. This year, we have dosed our equity risk well and capitalised on the tailwinds in the financial markets, while at the same time we have been skilled at selecting the right Danish equities. We note in particular that we have gen-erated good investment results to our customers when the markets fluctuate, which shows that we have a good and robust invest-ment strategy and risk management that we firmly believe will continue to deliver attractive returns in the future,” says Ole Krogh Petersen, who is expecting greater market fluctuations for the rest of the year:

“We still believe that pension customers will see a decent positive return in 2024, but we think that the expected return will be with lower in the second half of the year than in the first half. There will also be greater fluctuations in the markets, as indicated by recent weeks, the upcoming US election and the whole geopolitical situation,” he says.

The shares in particular have boosted returns in the first six months of the year. Customer returns range from 1.0 to 12.5 per cent in PFA Plus and from 1.7 to 12.3 per cent in PFA Climate Plus.

This year, PFA is working to adapt the company's investment profiles in order to deliver even better returns to customers in the future. The phase-in of the new investment profiles will begin from 1 April 2025 and are expected to be fully phased in by 1 January 2026.

“It's important that we constantly ensure that we give ourselves the best possible conditions to deliver returns and thus financial security to our customers. That's why we're working intensively this year to strengthen our investment profiles so that they are up-to-date and in the best possible position to continue to deliver top market returns to our customers,” says Ole Krogh Petersen.

Highest customer satisfaction

High customer satisfaction is essential in a customer community like PFA. It is therefore very gratifying that PFA has the most satisfied private customers among commercial pension companies in EPSI's annual survey, which was published in May. Among corporate customers in Aalund's Company Pension Barometer, PFA has made significant progress in terms of customer satisfaction, customer image and in the overall assessment, where PFA is in a joint first place.

“We thrive on having satisfied customers who are happy to be part of our customer community. That’s why we’re committed to delivering great customer experiences and that we have a good reputation. We are therefore pleased and grateful that we can see from the surveys and daily feedback that both private, corporate and organisational customers are satisfied,” says Ole Krogh Pe-tersen.

For more information

Contact Rikke Gredsted Seidenfaden, Head of Press at PFA, tel. (+45) 2758 9588, rgs@pfa.dk