Customer acquisition and growth - challenged markets impact the result

For PFA, 2022 ended with a negative result before tax. PFA continued acquiring more customers and had solid levels of growth, whereas in the claims area, in the first six months of the year PFA succeeded in helping more customers on long-term sick leave return to their jobs and stabilising the number of new claims which led to a better operating result in the second half of the year.

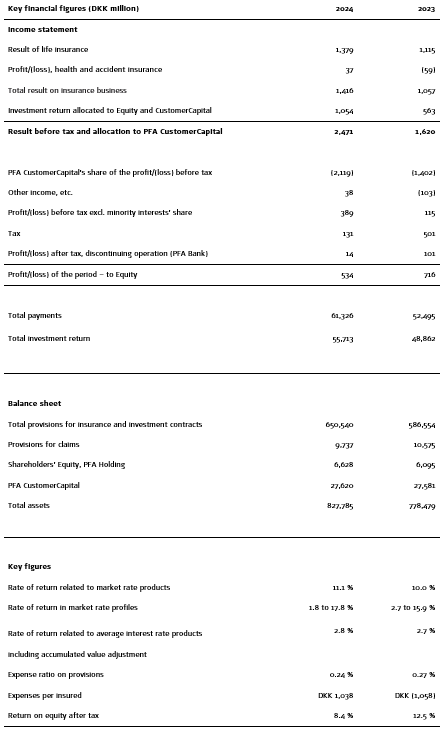

In 2022, PFA had a pre-tax result of DKK -128 million compared to DKK 190 million in 2021. The result is due to developments in the financial markets which led to prices falling in most asset classes.

“2022 has been a very unusual year due to the economic uncertainty from rising inflation, rising interest rates, a war in Europe, recession fears and negative financial markets. This has impacted our overall result,” says Ole Krogh Petersen, Group CEO of PFA.

Despite the negative overall result and the generally negative returns on the financial markets, PFA has decided to still provide its customers with a positive interest of 8 % on their CustomerCapital.

More customers and growth in payments

Last year, PFA continued its growth and the influx of more customers. The total payments amounted to DKK 46.2 billion in 2022 compared to DKK 43.8 billion in 2021, a growth rate of 5.4 %. The regular payments grew by 7.4 % in 2022, from DKK 26 billion to DKK 27.9 billion.

The net payments grew by 20 % from DKK 10.2 billion in 2021 to DKK 12.3 billion, and in 2022 PFA also had a net addition of 842 corporate and organisational customers, which is more than twice as many as in 2021, where this figure was 412.

“It is really positive that more customers are choosing PFA and that we are still growing and have a net increase in customers and payments. This shows that we have a strong value proposition with good solutions within healthcare, financial security, senior solutions and sustainability, and with that a strong market position,” says Ole Krogh Petersen, also noting positive trends in the health and claims area:

“The number of new customers on long-term sick leave has stabilised and we are succeeding in getting more customers back to work after a long-term illness. This, together with more balanced prices, has had a positive impact on our claims result.”

The solvency ratio remains at a continued high level at the end of 2022. Due to new rules for Solvency II models and a reduction of the VA addition etc., PFA has a solvency ratio of 208 % compared to 271 % at the end of 2021. This ensures that PFA can continue to pay the customers’ guaranteed benefits and honour its other commitments.

Results are impacted by financial effects from a tumultuous market

For PFA’s life insurance activities, the result is DKK -915 million, while the result for health and accident insurance is DKK 556 million. The total result on insurance business for 2022 is DKK -359 million compared to DKK 906 million last year. The difference is particularly a result of negative financial effects of approximately DKK -1.4 billion due to fewer assets under management, hedging activities and operational risk charges.

However, the total result on insurance business is significantly improved by DKK 287 million compared to the loss of DKK 646 million after the first six months of the year.

A better underlying claims result - initiatives are having an impact

In connection with the new Danish executive order on health and accident insurance (SUL), PFA has since 1 January 2022 re-written the occupational capacity insurance cover under life insurance instead of under health and accident insurance. The total result on insurance business of DKK -359 million is not impacted by where the insurance cover is established. However, the life insurance result would have been approximately DKK 450 million higher and the profit of the health and accident insurance business would have been reduced by the same approximately DKK 450 million to around DKK 100 million.

Overall, the underlying operating result from these types of insurance for health and accident as well as life insurance is still negative, but it has improved by more than DKK 300 million in 2022 compared to 2021. The improvements are thus in line with the plan to create balance in the insurance area, and the expectation is that the goal will be achieved in 2025 as the agreements concluded before the entry into force of the new rules expire.

PFA is focused on contributing to ensuring that fewer customers fall ill and to helping customers on long-term sick leave get well again and return to work for the benefit of themselves, the companies and society at large. In 2022, PFA stabilised the number of new cases of long-term sick leave among its customers and it also succeeded in helping more customers on long-term sick leave return to work. This, together with more balanced prices, has also resulted in a better operating result of the total of PFA’s insurance products compared to 2021.

“In 2022, PFA has helped 1,560 customers on long-term sick leave return to their job, and this is an increase of 19 % since 2021 and 62 % since 2019. In other words, we can see that our initiatives within the healthcare and claims area have an impact on our customers and this is very positive - and it also means that the operating result in the insurance area has improved. We would of course like to see things move faster, but we are sticking to the plan and expect to reach a balance in this area in 2025,” says Ole Krogh Petersen and continues:

“Despite improvements to operations and good results with helping our customers, the total result of insurance operations is not satisfactory, and this is mainly due to the negative developments in the financial markets.”

Historic challenges in the financial markets are impacting returns

In 2022, the financial markets were hit hard by global unrest, high inflation, ongoing interest rate increases and a growing risk of recession. In 2022, Global shares (MSCI ACWI) ended down 18.3 %, and interest rate increases have resulted in some of the largest price declines on government bonds in more than 40 years. This has had a negative impact on customers’ returns.

The overall returns in 2022 in the average interest rate environment after restatement at market value was -4.6 % while customers in the average interest rate environment can look forward to an addition of 3 % in deposit interest rate. In the market rate environment, customers saw negative returns ranging from -7.6 % to -12.2 % in PFA Plus and from -8.6 % to -14.9 % in PFA Climate Plus. In the same period, PFA’s broad portfolio of alternative investments and properties generated returns of, respectively, 3.0 % and 0.2 % and have thus performed significantly better than the market in general and this has served to keep customer’s returns from dropping too severely.

The return for a medium-risk profile for a person with 15 years to retirement was -10.9 % in 2022.

“Of course, it is painful to see that customers have had negative returns due to a very hard year for investing. However, it is positive that our customers are, relatively speaking, among those who have been least impacted in the industry. Every day we are working to ensure that our strategy and investment portfolios are as robust as possible. Here, our broad portfolio of unlisted investments together with a defensive and active asset management strategy and targeted risk management has mitigated the worst of the price declines for our customers in a very difficult and turbulent year on the financial markets,” says Ole Krogh Petersen and continues:

“The developments around the world and on the financial markets make it even more important that we are in dialogue with our customers and make them feel confident about their finances through good advisory services. We have been very aware of this in 2022, and this will also be a major focus area in 2023 because we want this to be our key competence. Our main message to customers when the markets are so volatile as they have been in recent years, is that it is important to remain cool-headed and remember that pension savings are long-term.”

Following 2022, a medium-risk profile for someone with 15 years to retirement has, over the past 5 years, seen total returns of 20.1 % and over the past 10 years the total returns are 86.4 %.

Additional information

Oliver William Gunner, Head of Press, (+45) 28 56 23 22 / owg@pfa.dk