Do you pay top-bracket tax? Make sure to use this advice before New Year

When the clock strikes midnight and fireworks light up the sky on New Year’s Eve, a new tax reform comes into effect. If you have some financial flexibility, here’s some advice on how you can make the most of your payment this year. PFA’s private economist explains how here.

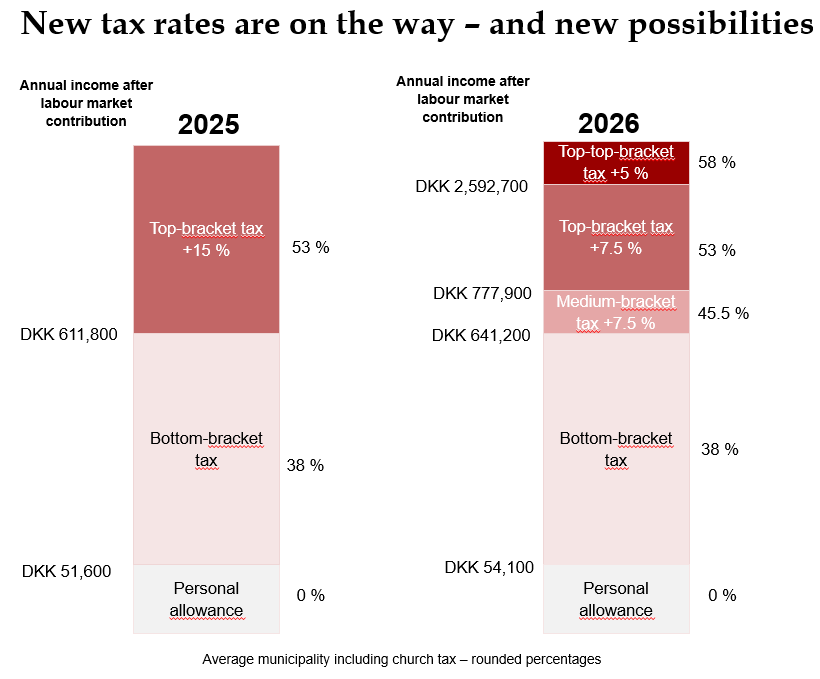

First, the good news for those earning from DKK 611.800 to DKK 2,900,000 a year after labour market contribution: Next year, your tax burden will be slightly lower. The bottom portion of your top-bracket tax of 15 per cent will be changed to a medium-bracket tax of 7.5 per cent, giving you a tax reduction.

On the other hand, if you earn more than DKK 2.9 million a year, you might find it less positive news that the tax system is changing. This is because, going forward, you will contribute a bit more to the wider community – as a new so-called top-top-bracket tax of 5 per cent will be implemented for income exceeding 2.592.700.

In both scenarios, PFA’s private economist Camilla Schjølin Poulsen has a top-bracket tax tip for those of you with a little extra savings who wish to boost your pension plan.

But first a quick overview of the new top-bracket tax rules. The top-bracket tax, which is currently 15 per cent, will be divided into three levels from 2026:

- A medium-bracket tax of 7.5 per cent on income over DKK 641,200.

- A top-bracket tax of 7,5 per cent on income over DKK 777,900.

- A top-top-bracket tax of 5 per cent on income over DKK 2,592,700.

All figures are after labour market contribution.

Do you earn more than DKK 611,800?

If so, here’s the good advice. If you are one of those who will only pay 7.5 per cent in medium-bracket tax going forward, it may be beneficial to consider boosting your pension this year before the value of tax deduction on your payment decreases from 53 per cent to 45.5 per cent.

“Many are familiar with the trick of making extra payments into their pension to avoid top-bracket tax. This means that if you are liable to pay top-bracket tax, you can instead contribute the excess part of your salary to your pension, thereby deferring the income until you retire and typically avoiding top-bracket tax. And, it is more advantageous to do this in 2025 rather than in 2026 for the part of income between DKK 611,800 and DKK 777,900,” explains Camilla Schjølin Poulsen.

Specifically, the value of your tax deduction is 7.5 per cent higher this year than next year, which means that if, for example, you pay an extra DKK 40,000 into your pension savings this year, you will get DKK 3,000 more back from the tax authorities than if you make the same payment after New Year.

“That’s DKK 3,000 more in your pocket after tax, and that’s certainly a noticeable benefit,” says Camilla Schjølin Poulsen.

Earning more than DKK 2,592,700?

If you are one of those who, from next year, will be asked to contribute a bit more to the public coffers with the upcoming top-top-bracket tax, the above tax advice actually applies to you as well – but only from next year.

If you are considering making extra payments to your pension and will be paying top-top-bracket tax next year, then you can easily wait until after the fireworks have been cleared away on 1 January. This is because it will be more tax-efficient to make payments to your pension from 2026, as the value of your deduction will increase by 5 percentage points, from approximately 53 per cent to 58 per cent.

What to do

Has this got you thinking, and are you now considering making extra payments to your pension savings? You can do this either through your employer or as a private single payment.

“Often, it is easiest to simply ask your employer to increase the monthly payment through your salary, either as a fixed amount each month for the rest of the year or as a percentage of your salary. This way, you avoid making a significant financial contribution upfront but will simply receive slightly less salary for the rest of the year,” says Camilla Schjølin Poulsen and continues:

“Alternatively, you can make a single payment into your pension savings, which means you will receive a tax refund in April next year. A good tip, however, is that if you update your preliminary income assessment for 2025 with the lower income after making the payment, your tax will be reduced already this year, so you won’t have to wait until April,” she says.

You can read more about how to save extra and try our calculator, which shows how your money can grow depending on how much you contribute and the level of risk you have chosen.