Results 2023: Attractive returns for customers and record-high payments

In 2023, PFA's customers obtained attractive returns at the top of the commercial pension market, with payments at record levels, reaching DKK 52 billion for the first time in PFA's history. PFA's performance has also improved significantly, and despite major challenges in societal health, the insurance operations continue to progress significantly and is on track to be in balance by 2025.

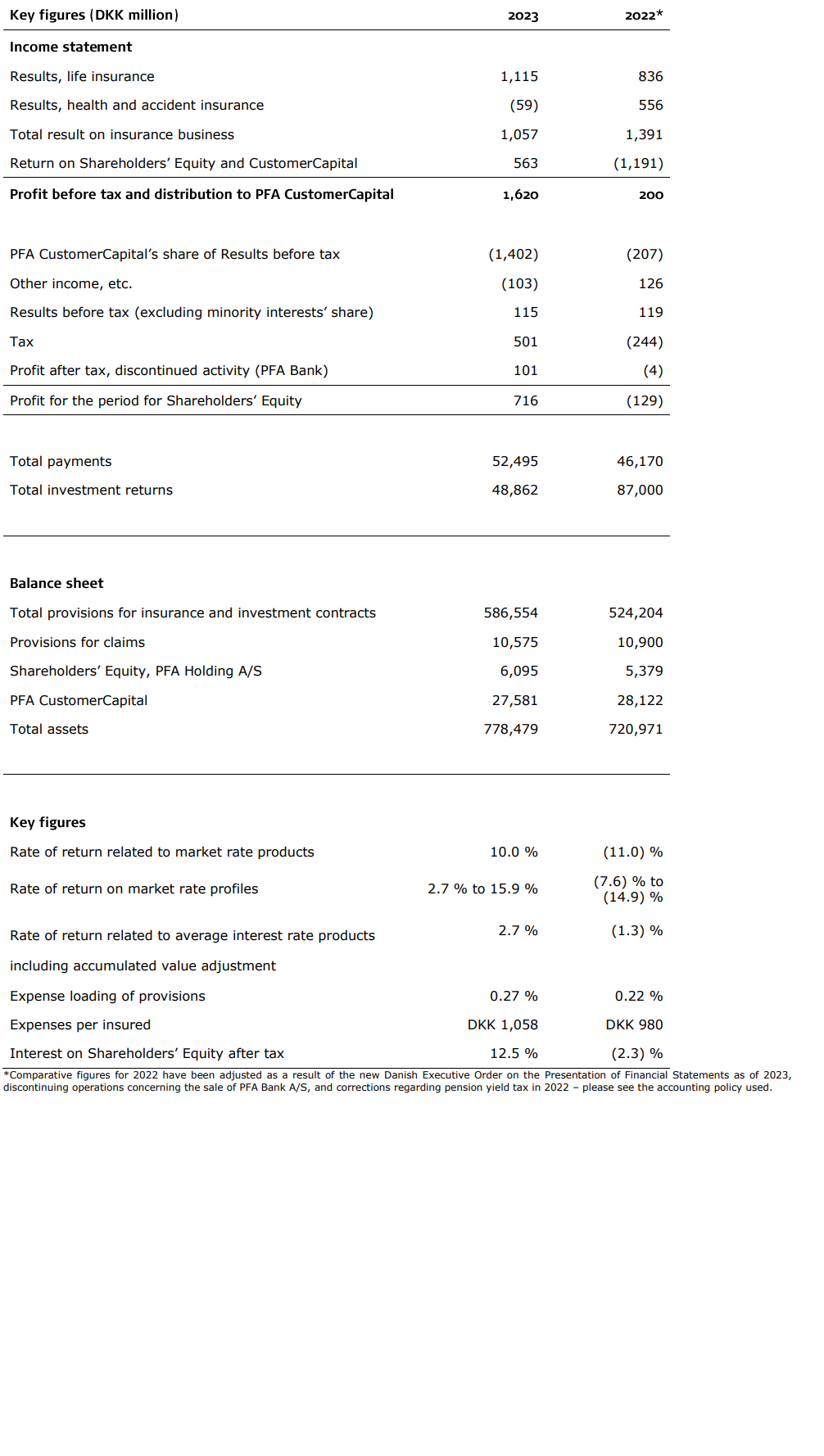

In 2023, PFA had a profit before tax and profit sharing with its customers of DKK 1,620 million, against DKK 200 million in 2022.

The strong improvement in this result is due in particular to an improvement in the investment return on the capital base as a result of the favourable financial markets, as well as improved underlying operations and a large influx of customers over the past few years.

“2023 was a favourable financial year for our customers and with that, also for PFA. Customers have now enjoyed solid returns at the top of the commercial pension market over the past three years in a time where the markets have been going up and down, which is something we’re pleased about, as it provides financial reassurance to customers. I also note that for the first time in PFA's history we are reaching DKK 52 billion in payments, thanks to a large influx of new customers and the retention of our existing customers. This means that together our customer community and our business are growing significantly. Overall, we are very happy with the results we’ve achieved in 2023,” says Ole Krogh Petersen, CEO of PFA.

PFA’s profit benefits customers in the form of profit-sharing through PFA’s CustomerCapital. In the spring of 2024, PFA once again expects to pay DKK 1.7 billion to its customers in interest on the individual CustomerCapital for 2023.

More customers and record high payments reach a milestone

In 2023, PFA had a marked growth in payments from customers compared with 2022.

Total payments came to DKK 52.5 billion, compared with DKK 46.2 billion last year. This is a growth of 13.7 per cent, and the payments are the highest PFA has ever seen in a half year period.

The growth is due to an increase in current payments of 7.4 per cent from DKK 27.9 billion in 2022 to DKK 30 billion in 2023. In addition, single payments during the period have increased by 23.3 per cent from DKK 18.3 billion to DKK 22.5 billion, while net payments (payments minus payouts) have grown by 41.4 per cent from DKK 11.6 billion in 2022 to DKK 16.4 billion in 2023. The large increase in net payments shows that PFA's business is growing markedly. The influx of new customers and good investment results meant that customer funds increased by DKK 62 billion from DKK 552 billion in 2022 to DKK 614 billion in 2023.

In 2023, PFA saw a net addition of 901 corporate and organisational customers. This is an increase compared to the same period last year where the figure stood at 842.

“This is a great show of confidence in PFA, and we are proud that so many customers choose PFA as their pension provider. The high growth in payments and the large net addition of new customers show that we have a really strong position in the market with good overall value offers for customers. The cornerstones of our value offers consist of financial security, good healthcare and senior solutions as well as corporate responsibility, which are also the areas most in demand among our customers and thus in society. With our new strategy 'Focused Customer Community', these are also the areas in which we will focus and further improve on in the coming years,” says Ole Krogh Petersen.

Continued growth in health and accident insurance plans

In connection with the new Danish executive order on health and accident insurance, since 1 January 2022, PFA has been writing, among other things, occupational capacity insurance under life insurance instead of under health and accident insurance. Overall, the current operating profit of this type of insurance lands at DKK -974 million, which is a significant improvement of DKK 477 million compared to 2022, when the result was DKK -1,451 million. Thus, PFA is following the turnaround plan within health and accident insurance and expects to remain in balance throughout 2025.

Progress in 2023 can be attributed to three overriding factors.

Firstly, PFA continues to help more customers to avoid long-term illness. In 2023, PFA's healthcare experts were consulted by its customers 314,000 times – an increase from the 282,000 conversations held in 2022. At the same time, PFA has also helped over 110,000 children and adults with treatment programmes aimed at preventing long-term illness. This is an increase of 16 per cent on the previous year. The development is mainly driven by the fact that more customers have needed help and advice for mental health issues or musculoskeletal injuries, as well as the fact that PFA has increased its proactive efforts towards the customers and their health.

Secondly, PFA has maintained focus on helping employees on long-term sick leave get back to work, with 1,666 customers returning to the job market by 2023. Overall, PFA has helped 6 per cent more customers return to work compared to 2022, when 1,568 customers were reported fit to return to work.

Thirdly, insurance prices have become more balanced and, combined with the initiatives, have led to a substantial financial effect and improved results.

“We can see that our comprehensive efforts towards offering customers quick and proper help have taken effect, and we are trying to prevent long-term illness by now proactively reaching out to any customers who need help. In this way we are helping more customers to remain at full working capacity and to stay healthy. At the same time, we see a serious development in mental disorders which is a major challenge that we, here at PFA and in society as a whole, must address. And, we are prepared to continue taking a great responsibility,” says Ole Krogh Petersen.

When looked at on its own, the result of the remaining health and accident insurance in 2023 totalled DKK -59 million and thus close to balance in this area of the insurance operations. The result in 2022 amounted to DKK 556 million and was exceedingly positively affected by one-off corrections.

If the health and accident insurance result had been calculated as before one part was transferred to the life insurance operations from 2022, the result in 2023 would have been approximately DKK -600 million.

Customers’ pension savings grow significantly

2023 was a good year for the financial markets. The year began with dark clouds looming over the economy in the form of high inflation, concerns of a recession and collapses in the US banking sector, but towards the end of the year in particular, the markets actually rose and subsequently, so did the customers’ return on their pension savings.

A typical customer with 15 years to retirement in PFA's recommended Profile C in the market rate environment can enjoy a return of 12.1 per cent, which is at the top end of the commercial pension market. Over the past three years, PFA returns have remained at the top of the commercial pension market.

“Over the past three years, we have created a return of 15.2 per cent for an average customer and this is despite the major downturn of the financial markets in 2022. It provides financial security to our customers, and we are pleased that we have generated returns at the top of the commercial pensions market. This goes to show that we have a sound and robust investment strategy that adjusts our risk so that we are able to mitigate the worst losses when markets fall, as in 2022, and also come in handy when markets take a positive turn again as they did in 2023. It also gives us confidence and expectations that in the coming years we can continue to deliver attractive returns to our customers at the top of the market,” says Ole Krogh Petersen.

The good investment results can be attributed, in part, to effective risk management.

“In the first half year we have been good at adapting our investment risk in line with the drop in inflation. Growth prospects and employment have been a continuous positive surprise and resulted in fair winds on the financial markets,” says Ole Krogh Petersen.

Equities in particular have increased the returns in 2023. Customer returns range from 2.7 to 15.9 per cent in PFA Plus and from 3.9 to 10.9 per cent in PFA Climate Plus. This difference in return between Klima Plus and PFA Plus is due, among other things, to the fact that many of the industrial companies in Climate Plus have been particularly hard hit by increased costs due to inflation, interest rate rises and bottlenecks. If you are saving up in the average interest rate environment and have individual CustomerCapital, you have seen an annual interest of 1.9 per cent on savings in 2023 before pension yield tax.

Sale of bank and new model for profit-sharing

In September, PFA launched the company's new 'Focused Customer Community' strategy, which runs until the end of 2025. Here, the key words are focus, simplification and improvement, and as part of this, two significant changes were already made in 2023.

In 2023, PFA Bank was sold to Jyske Bank. As part of the transaction, it was agreed between the parties that PFA will transfer the administration and management of the Investeringsforeningen PFA Invest during 2024. The margin for the transaction is DKK 101 million, which is recognised in the accounts for 2023 under the item “discontinued activity”.

PFA also announced in 2023 that the model for profit and risk sharing with customers, PFA CustomerCapital, has changed as of 1 January 2024. The expected return on CustomerCapital has been raised to 10 per cent against 8 per cent previously. Interest for the 2024 financial year is attributed to customer deposits in the spring of 2025. The share of new payments that goes to CustomerCapital will be lowered from 5 per cent to 2 per cent. New customers can now top up to 2 per cent in CustomerCapital on transfer of pension savings from other companies. In future, existing customers will receive the expected return of 10 per cent on their total accumulated CustomerCapital – both from the existing part and the new payments.

“It is important that we constantly adjust our business and value offers in order to retain and expand our position as the market leader in a strongly competitive market. If we succeed in focusing, simplifying and improving our business, it will benefit our customers in the form of higher returns on CustomerCapital, better service or lower prices. PFA is a customer community where everything we do and the value we create benefits our customers, which is why we are pleased to have delivered such strong results in 2023,” says Ole Krogh Petersen.

For more information

Contact Nis Refslund Poulsen, Senior Press Officer, tel. (+45) 2763 6425, nrp@pfa.dk

Financial highlights for the PFA Group