Continuing growth and steady operations in a difficult half-year for investments

During the first half year of 2022, PFA experienced solid growth and steady business operations, while the overall result was impacted by the negative development on the financial markets.

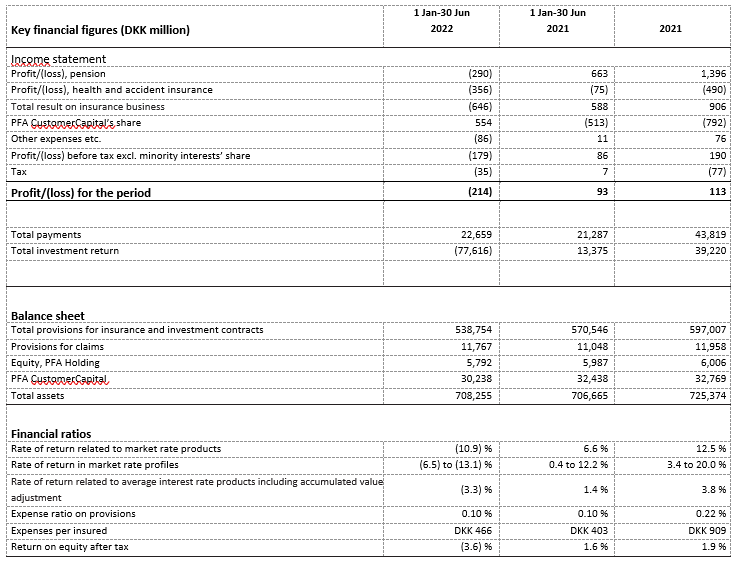

For the first half year of 2022, PFA ended up with a pre-tax result of DKK -214 million compared to DKK 93 million in the same period of last year. The development in results is mainly driven by the historic unrest and volatility in the financial markets, which are characterized by high inflation, rising interest rates and major price declines in equities and bonds.

During this period, PFA has still had steady operations and growth in business. The total payments now amount to DKK 22.7 billion in the first half of 2022 compared to DKK 21.3 billion in the first half of 2021, and this is at record levels for a half year. In the first half of 2022, PFA has also had a net addition of 419 corporate and organizational customers, which is more than all of 2021, when the figure totaled 412.

Mads Kaagaard, Interim Group CEO, says:

“Our result should be viewed in the light of historic challenges in the financial markets. With high inflation and the continually rising interest rates and the growing risk of a recession, we have felt the impact across our business. At the end of the first half year, however, we continue to see a stable development in the underlying operations at PFA, and we are consolidating our solid position in the market for commercial pension companies with increasing payments and a net growth of 419 corporate and organisational customers.”

The solvency ratio remains at a high level in the first half of 2022. PFA has a solvency ratio of 249 % compared to 271 % at the end of 2021, and this ensures that PFA can continue to honour the customers’ guaranteed benefits and its other commitments.

The insurance area is impacted by fiscal effects of the market unrest

In connection with the new Danish executive order on health and accident insurance, PFA has, since 1 January 2022, rewritten occupational capacity insurance cover under pension instead of under health and accident insurance. For pensions, the result ended at DKK -290 million, while the result for health and accident insurance is DKK -356 million. The total result in insurance business for the first half of 2022 is DKK -646 million compared to DKK 588 million in the same period last year.

The results for pensions as well as health and accident insurance are impacted by the developments in the financial markets, including a negative financial result of DKK -324 million for health and accident insurance. To a significant extent, the developments in the combined result on insurance business can thus be attributed to the unrest in the financial markets. Of the result of DKK -646 million, DKK 554 million is covered by collective CustomerCapital.

In spite of the result, PFA held on to the payment of interest on the customers’ individual CustomerCapital. In the first half of 2022, PFA forwarded a profit of DKK 1.6 billion to the customers’ savings through PFA CustomerCapital.

Initiatives to improve the result on insurance business are having an impact

PFA has a targeted focus on improving the results from insurance products under health and accident insurance as well as pensions. At the end of the first half year, the operating result for PFA’s combined insurance products improved compared to the same period last year.

“Our operations on the insurance area have improved, and we can see that our initiatives are working even though we would like to see things move faster. The improvement in the operating result for the insurance area is driven by our work on increasing prices, focusing on preventive measures and increasing our efforts to help more customers who are on sick leave get back to work,” says Mads Kaagaard, and continues:

“Despite the improvements in our operations, the total result for the insurance area is unsatisfactory, and this is mainly due to the volatile financial markets having a negative impact on the result. However, our initiatives are proceeding as planned and we expect to be in balance in 2025.”

In the first half year, PFA has helped approximately 600 employees on long-term sick leave return to work, which is an increase of 81 % since the first half of 2018 and a 25 % increase since the same period last year. This is a positive development both for individuals, companies and society at large.

On 1 January 2022, a new Danish executive order on health and accident insurance entered into force, and this has resulted in an increase of the general market prices for insurance products such as, for example, occupational capacity insurance, critical illness and health insurance. In the future, this new level for insurance prices is expected to make a significant contribution towards bringing the results for insurance products into a more balanced state.

Historic challenges in the financial markets are impacting returns

In the first half year, the financial markets have been strongly impacted by high inflation, continuing rising interest rates and the growing risk of recession. In the first half year, global shares (MSCI ACWI) were down by 20 %, and interest rate increases have resulted in some of the largest price declines on government bonds in over 40 years. This has had a negative impact on customers’ returns.

The total return in the first half year was DKK -31.2 billion in the average interest rate environment, of which the majority originates from the negative returns from interest hedging of the pension provisions, and thus partially counterbalanced by an equivalent decrease in the market value of these. Average interest rate customers can look forward to an addition of deposit interest of 3 %. The return in the market rate environment was DKK -43.5 billion, which corresponds to negative returns ranging from -6.5 % to -13.1 % in PFA Plus and negative returns ranging from -7.0 % to -15.8 % in PFA Climate Plus. In the same period, PFA’s broad portfolio of alternative investments and properties in the market rate environment has generated returns of, respectively, -0.3 % and 4.7 %, and has thus performed significantly better than the market in general and this has had a positive impact on the returns.

The return for a medium risk profile with 15 years to retirement was -11.2 % after the first half year. However, this loss has been reduced significantly since then and is -7.9 % at 29 August.

“It has been a very difficult year in terms of generating returns so far, and it is painful to see that customers have had negative returns. We can see, however, that almost one third of the returns which were lost since the half year were regained at the end of August. At PFA, we work with the portfolios every day to ensure that they are as robust as possible. For many years, we have built up a solid portfolio of unlisted investments - including properties. This makes our investment portfolio more diverse, and it has helped to cushion the worst of the price declines together with a defensive equity portfolio management and targeted risk management,” says Mads Kaagaard and elaborates:

“The current developments in the financial markets make it even more important that we are in close dialogue with our customers, as we do not expect that the developments will reverse into a positive trend in the short run. When the markets move up and down so quickly, it is important to remain calm and remember that a pension is a long-term savings plan. If we look at developments since the beginning of 2021 and until the end of the first half year in June, a medium risk profile with 15 years to retirement still have positive returns of 2.2 % overall.”

After the first half year of 2022, a profile with medium risk and 15 years to retirement has, in the past 5 years, received a total return of 25.1 %, and seen over the past 10 years, the total return is 98.7 %.

Additional information

Oliver William Gunner, Head of Press, (+45) 28 56 23 22 or owg@pfa.dk