Adjust your savings to match your retirement expectations

Many dream of an early retirement, but it may turn out to be very costly. Find out why and hear PFA’s consumer economist explain how greater life expectancy affects how soon you can have your public old-age pension paid out.

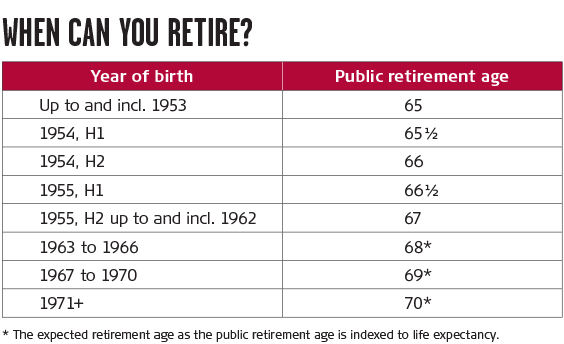

Our life expectancy increases faster than first anticipated, and therefore it has been politically decided to gradually raise the public retirement age. The idea is that everyone receives public old-age pension for a period of approximately 15 years. When the retirement age is raised, those who want to retire early must be even more aware of whether the size of their savings is sufficient. PFA’s consumer economist Carsten Holdum points to two very important things to keep in mind if you choose to retire before reaching the public retirement age and thus have to finance the extra years yourself.

Expensive extra years

Retiring early while almost maintaining your current standard of living may turn out to be a stiffly priced decision.

”If you want to retire already when you turn 65 – instead of when you turn 67, which is the current public retirement age – it will cost you both directly and indirectly. You have to both cover your living expenses during the two years as well as the two years’ worth of savings that will not be added to your pension savings. It may prove costly to retire early,” Carsten Holdum states.

Of course, you can choose to retire early and not make any payments to your pension savings. In that case, you simply have to make do with less money in retirement. ”It is your decision alone, but it is important that you are aware of the price of your decision," Carsten Holdum says.

In 2022, the public retirement age will be raised to 67 and a further rise to 68 is planned in 2030. Realistically speaking, we will witness the retirement age moving past age 70 in future. Just based on the current initiatives, it may be a good idea to crank up your pension savings if you plan for an early and long retirement. Retiring too early is costly.

Early retirement means a less luxurious lifestyle

If you for instance want to retire when you turn 65 and, at the same time, want the same standard of living as people who retire at age 68, you need to increase your monthly pension payments significantly. If your annual income totals DKK 450,000, and your monthly pension contribution stands at 15 %, you need to increase your monthly contribution by DKK 2,400 before tax for 35 years. This corresponds to a monthly visit to a high-class restaurant or a new pair of glasses – every single month. If you choose to retire one or two years before you reach the public retirement age, you need to increase your monthly pension payments by DKK 800 or DKK 1,600 respectively if you want to maintain your standard of living.

”Many people dream of an early retirement – some wish to retire already when they turn 60, just like their parents might have. Back then, an early retirement was realistic, whereas today most people cannot afford to stop working so soon," Carsten Holdum notes.

He adds that it is important to relatively early decide what you want and what you can afford. Otherwise, you might be in for an expensive surprise.

”Retiring earlier than what you can afford is like travelling business class, enjoying it while it lasts, and then having to watch every penny for the rest of your holiday,” Carsten Holdum says.

An important decision

Carsten Holdum has been a personal finance adviser for many years, and he doesn’t have to think twice about his personal recommendation for the average pension customer who wishes to retire early.

"Once you have looked at what you can afford, what kind of life you want to lead and the cost of it, it is my belief that most will benefit from working a few extra years,” Carsten Holdum concludes.

PFA’s Advisory Services Centre can advise you about your options. For instance, we can help clarify various financial scenarios as well as the lifestyle you will be able to afford if you retire early, as planned or if you postpone retirement a few years. This way, you will be equipped to make the decision that suits your life the best.

Are you saving enough for your retirement?

Some advice on retiring early

- If you want to have the option of retiring early, you need to consider what that will take at a relatively early age (before turning 50). How much money do you need in retirement, and can you live with having to spread your payments over more years than originally planned? If not, are you then prepared to increase the payments you make to your pension plan?

- Strong pension savings pays off as it provides you with a great deal of flexibility. This way, it is up to you – and not the size of your savings – to decide when and how you want to retire. At present, the level of interest rates is relatively low. This means that the return on your pension savings in the years to come is expected to be lower than the return you have received so far. Meaning that your savings will not increase as much, and you will therefore be more dependent on your own payments.

- If you are married or live with your partner, it is a good idea for you and your partner to coordinate your pension savings to ensure that you can enjoy retirement together without any unnecessary financial worries. Even though you are a couple, your pension pots are generally completely separate. Therefore, it is important that, as you approach retirement, you and your partner look at your options, and that you preferably draw up a retirement budget together. PFA’s advisory services can assist you if you need any help.