Change your voluntary contribution

Do you want to change your voluntary contribution?

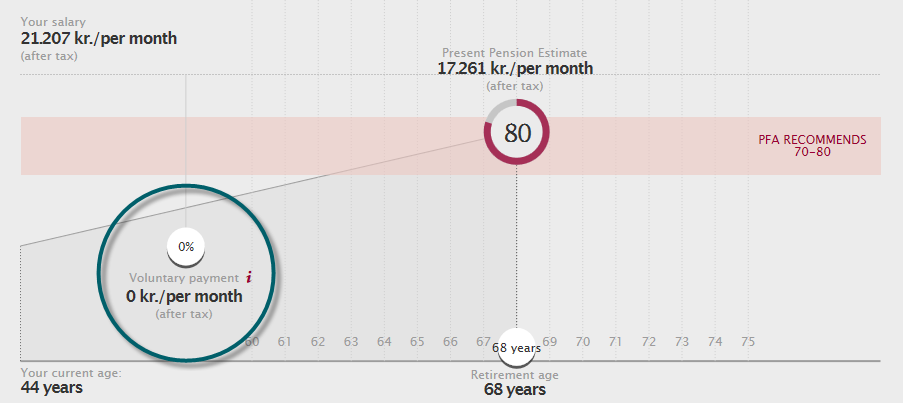

Log on to My PFA to adjust your voluntary payments and see how your Pension Estimate changes.

What to do at My PFA

Adjust your voluntary payments by dragging the circle above “Voluntary payments”.

Afterwards, you can approve the change or place it in Orders if you have other matters to look at in your plan.