PFA delivered strong returns to its customers and payments were record high

The first six months of the year turned out favourable for PFA customers and, with that, also for PFA. Customers have gained attractive returns and payments are at a record high level. PFA’s results have also improved, and the insurance operations continue to show significant progress and are on track with the plan towards being balanced in 2025.

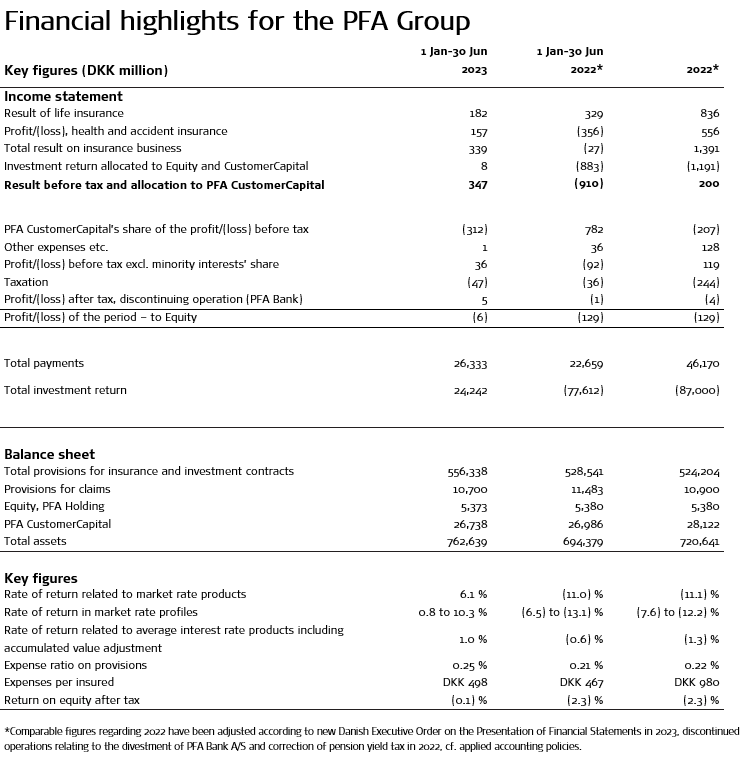

For the first half year of 2023, PFA had a result before tax and profit-sharing with the customers of DKK -347 million compared to DKK -910 million in the same period last year.

The progress in the results is primarily due to more favourable financial markets during the first half-year compared to last year as well as a considerable improvement in the underlying operation.

“Our customers and PFA came rather well out of the first half year. After a difficult 2022, it is positive that we can deliver solid and positive returns at the top of the commercial pension market. I am pleased that more new customers are choosing us and that we are able to retain our existing customers. This leads to high growth in payments and means that our business and customer community is growing significantly,” says Ole Krogh Petersen, CEO of PFA Pension.

PFA’s profit benefits customers in the form of profit-sharing through PFA’s CustomerCapital. In 2023, PFA paid out DKK 1.7 billion to customers in interest on individual CustomerCapital plans.

Increase in customers leads to record high payments

In the first six months of the year, PFA had a significant growth in payments compared to the first half year of 2022.

The total payments amounted to DKK 26.3 billion in the first half year compared to DKK 22.7 billion in the same period last year. This is a growth of 16 per cent and the payments are the highest PFA has ever seen in six months.

Behind the growth is an increase in regular payments compared to the first half of 2022 of 6 per cent from DKK 14.1 billion to DKK 14.9 billion and an increase in single payments of 34 per cent from DKK 8.6 billion to DKK 11.5 billion. Net payments (payments minus payouts) grew by 53 per cent from DKK 4.9 billion in the first half year of 2022 to DKK 7.5 billion in the first half year of 2023.

In the first six months of 2023, PFA had a net addition of 485 corporate and organisational customers. This is an increase compared to the same period last year when the figure was 419.

“The high growth in payments and the large net addition of new customers show that we have a really strong position in the market with a good, strong value offer to customers. The cornerstones in our value offer are financial security, favourable health and senior solutions and social responsibility. These are also areas that are in demand - in the market and in society. We will increase our focus on these areas in the coming years,” says Ole Krogh Petersen

Growth in health and accident insurance

In the first half year, the result from health and accident insurance is DKK 157 million compared to DKK -356 million for the same period last year.

In the first half year, the result from health and accident insurance is DKK 157 million compared to DKK -356 million for the same period last year.

In connection with the new Danish executive order on health and accident insurance, since 1 January 2022, PFA has been writing, among other things, occupational capacity insurance under life insurance instead of under health and accident insurance. If you look at the continuous operating results of this type of insurance, it basically lands on DKK -570 million, which is an improvement of DKK 340 million compared to the same period last year. In this way, PFA is following the restoration plan on health and accident insurance with a view to being in balance during 2025.

The growth in the first half year is due to three overall factors.

Firstly, PFA continues to help more customers to avoid long-term illness. For example, in the first half of 2023, PFA helped 67,000 customers through treatment programmes for the prevention of long-term illnesses. This is 16 per cent more than in the same period last year when PFA helped 58,000 customers. The increase is primarily driven by more customers needing help and counselling for mental disorders or for injuries in the musculoskeletal system.

Secondly, PFA focuses on helping customers on long-term sick leave back to work where, in the first half of the year, 816 customers returned to the labour market – currently, the number has already exceeded 1,000.

Thirdly, insurance prices have become more balanced and, in combination, the initiatives, have led to a substantial financial effect and improvement of the results.

“We can see that our comprehensive work of offering customers quick and proper help is effective, and we are trying to prevent long-term illness by reaching out proactively to customers who need help. In this way we help more customers to recover and remain fit for work. At the same time, we see a serious development in mental disorders which is a major task we, at PFA and in society, have to address,” says Ole Krogh Petersen.

Strong half year for the customers’ pension savings

Despite the dark clouds over the economy at the beginning of the year in the form of high inflation, recession concerns and collapses in the American banking sector, the first half of 2023 has generally had fair winds on the financial markets.

This also rubbed off positively on PFA where a typical PFA customer in the recommended profile C in the market rate environment can look forward to a return of 7.6 per cent, which is at the top of the commercial pensions market. The development has continued and, consequently, at the end of July the return was 9.4 per cent for this customer group.

“Over the past three years, we have generated a return of 22 per cent for an average customer and this is despite the major downturn on the financial markets in 2022. I am very pleased that we have generated returns that make it to the top of the commercial pension market. It proves that at PFA, we have a good and robust investment strategy that adapts to our risks, so that we have been able to ward off the worst losses when the markets fell as they did in 2022. At the same time, we had a good start again when the markets became more positive as they did this year,” says Ole Krogh Petersen.

The good investment results this year have come about on the basis of an effective risk management and increased exposure to the American shares, among other things.

“In the first half year, we have succeeded in adapting our investment risk concurrently with the drop in inflation. Growth prospects and employment have been a continuous positive surprise and resulted in fair winds on the financial markets,” says Ole Krogh Petersen.

The shares in particular have raised the half year returns in 2023. Customers’ returns range from 0.8 - 10.3 per cent in PFA Plus and from 0.9 - 7.4 per cent in PFA Climate Plus. If you save up in the average interest rate environment, a deposit interest rate at the amount of 1.6 per cent p.a. before pension yield tax has been added in the first half year of 2023.

Sale of bank and new model for profit-sharing

In PFA’s new strategy, which will be launched in September, the key words are focus, simplification and improvement, and as part of this, two significant changes have already been made in the first half of 2023:

In June, PFA announced its divestment of PFA Bank to Jyske Bank. As part of the transaction, an agreement was made that the Jyske Bank Group will take over the administration and management of Investeringsforeningen PFA Invest. The price for the transaction is DKK 245 million, which is not recorded in the accounts for the first half year but will be recorded when the transaction expectedly is finally concluded in the second half of the year.

PFA also announced in June that the model for profit and risk sharing with its customers, PFA CustomerCapital, will change from 1 January 2024 . In future, the expected interest on CustomerCapital will be increased to 10 per cent compared to 8 per cent today. The percentage of new payments that goes to CustomerCapital will be reduced from 5 per cent to 2 per cent. New customers can now top up to 2 per cent in CustomerCapital on transfers of pension savings from other companies. Existing customers will receive an expected interest of 10 per cent on the entire CustomerCapital portfolio from both existing and new payments.

“It is important that we constantly adjust our business and value offers in order to retain and expand our position as market leader in a strongly competitive market. If we succeed in focusing, simplifying, and improving our business, it will benefit our customers in the form of even more returns on CustomerCapital, better services or lower prices. PFA is a customer community where everything we do benefits the customers,” says Ole Krogh Petersen.

For more information

Contact Oliver William Gunner, Head of Media Relations, (+45) 2856 2322 / owg@pfa.dk