PFA delivers a strong first half year

During the first six months of the year, payments to PFA increased by 26 per cent compared to the same period last year. Over the past three years, payments have grown by more than 64 per cent. PFA’s bottom line has also improved significantly, partly due to the health and accident insurance area reaching balance. Despite a turbulent first half year, PFA customers received positive and competitive investment returns.

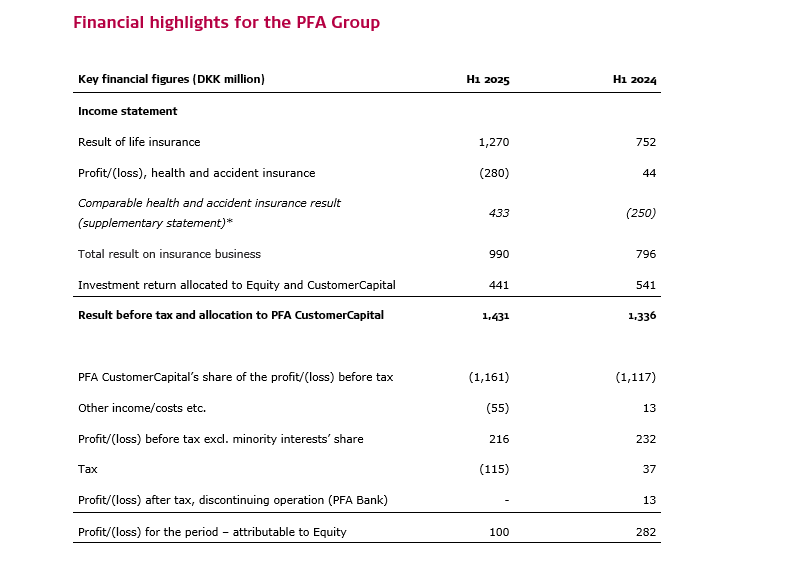

PFA recorded a profit before tax and profit-sharing with the customers of DKK 1,431 million in the first half of the year against DKK 1,336 million in the same period in 2024.

The increase in profit is primarily due to improvements in the health and accident insurance area, strong investment results and a substantial inflow of customers in recent years.

“It has been a strong six months for PFA. We are particularly pleased with the significant growth in our customer community and the record-breaking increase in payments, reflecting that both new and existing customers are choosing us. Our growth benefits the entire customer community by creating greater economies of scale, enabling us to invest in even better customer solutions, enhanced services and lower costs for our customers. Additionally, it is a milestone for us that the overall health and accident insurance area is now finally in balance. The strong overall result demonstrates that we have a healthy business with growth in both the top and bottom lines”, says PFA’s CEO, Ole Krogh, and continues:

“PFA is a customer community, and our significant progress benefits customers through profit-sharing, better solutions, improved service and lower costs. Furthermore, we are very pleased that, despite global and financial market turbulence, we have once again delivered positive and competitive investment returns to our customers in the first six months of the year. Overall, we are very satisfied with the first half of the year”, says Ole Krogh.

PFA’s profits benefit customers in the form of profit-sharing through PFA CustomerCapital. In the spring, PFA paid DKK 2.1 billion to customers as interest on Individual CustomerCapital for 2024.

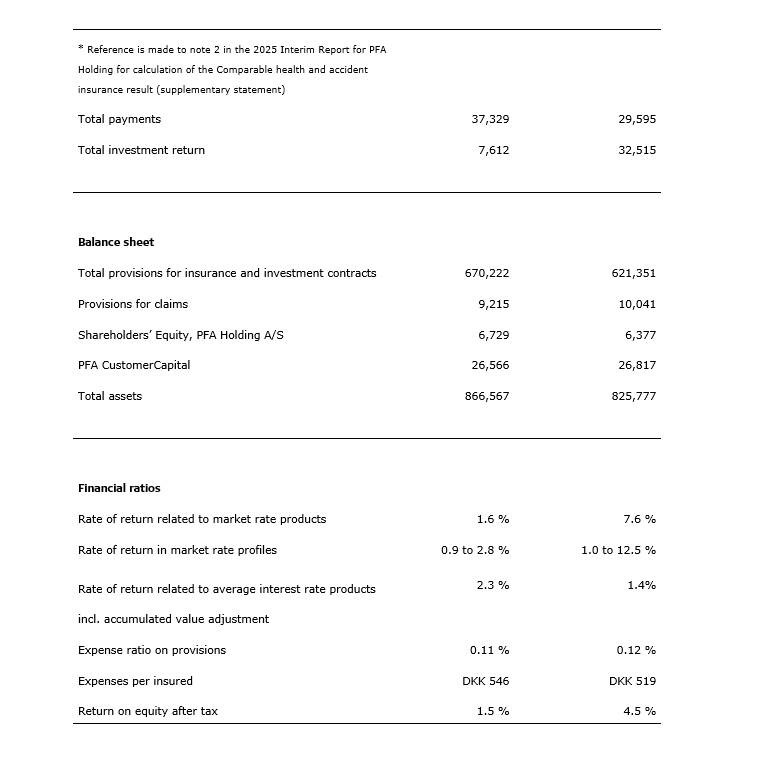

Significant inflow of new customers

During the first six months of the year, PFA experienced substantial growth in customer payments compared to the same period in 2024. Payments totalled DKK 37.3 billion, up from DKK 29.6 billion during the same period last year, representing a 26 per cent increase – the highest payments PFA has ever recorded in a half-year period. Over the past three years, customer payments to PFA have grown by 64 per cent. By comparison, payouts during the first six months of the year increased by only 4 per cent, from DKK 22.7 billion for the same period in 2024 to DKK 23.6 billion.

As a result, the net payments in the first six months of 2025 doubled to DKK 13.8 billion, up from DKK 6.9 billion in the same period last year. Net payments represent total payments minus total payouts and indicate PFA’s growth beyond investment returns.

The considerable growth in payments results from a 9 per cent increase in regular payments, which rose to DKK 17.6 billion in the first half of 2025, compared to DKK 16.1 billion in the same period in 2024. Additionally, single payments during the period increased by 47 per cent to DKK 19.8 billion, up from DKK 13.5 billion last year.

In the first six months of 2025, PFA achieved a net inflow of 717 corporate and organisational customers, representing a 26 per cent increase compared to the same period last year, when the figure was 567. This net inflow includes nearly 18,000 persons and DKK 1.3 billion in regular payments.

The influx of new customers and strong investment results contributed to an increase in customer funds, which rose by DKK 49 billion to DKK 697 billion by the end of the first half of 2025, compared to DKK 648 billion after six months of 2024. In the first six months alone, customer funds grew by DKK 19 billion, despite challenging and volatile financial markets. As of 26 August, PFA’s total customer funds amount to DKK 715 billion.

“Our customer community is growing very significantly in these years, and this is a great demonstration of confidence, which we work hard every day to live up to. The high growth in payments and the substantial net inflow of customers demonstrate that we are strongly positioned in the market with a solid reputation and a compelling overall value proposition for our customers. The cornerstones of our value proposition are financial security, strong health and senior solutions, and social responsibility – areas that are in demand among our 1.3 million customers and society at large. These are also the areas where we will focus and further improve in the coming years,” says Ole Krogh.

Milestone achieved: Health and accident insurance in balance

Since 1 January 2022, PFA has underwritten new occupational capacity insurance cover under its life insurance business, while health and accident insurance underwritten before 2022 are accounted for under the item “Health and accident insurance”. Since the 2024 annual report, an additional accounting note has been introduced to present the total result for all health and accident insurance at PFA, comparable to other commercial pension companies. This is referred to as the “Comparable health and accident insurance result (supplementary statement)”.

Overall, the result for all health and accident insurance at PFA (Comparable health and accident insurance result) for first half of 2025 stands at DKK 433 million, compared to a loss of DKK 250 million in the same period last year, underlining that the area is now in balance. The result is influenced, among other factors, by a release of provisions amounting to DKK 244 million, positive investment returns of DKK 317 million, and an operating loss (premium payments minus claims expenses) of DKK 93 million.

Unfortunately, we continue to see a high number of new claims from our customers. However, it is positive that, for an extended period, fewer customers are experiencing long-term illnesses, and more of those on long-term sick leave are returning to work faster. In addition to the overall balance achieved in the health and accident insurance area, it is still expected that the current operating loss of DKK 93 million will also balance during 2025 through continued focus on the initiatives described below.

The part of the comparable health and accident insurance result that includes insurance plans underwritten before 2022, and which is reported under the item “Technical result of health and accident insurance”, shows a stand-alone negative result of DKK 280 million. This is primarily due to an increase in provisions for older claims, which negatively impacted this result by DKK 316 million. Conversely, provisions for new claims (underwritten after 1 January 2022) have been reduced and are included in the comparable health and accident insurance result but not in the above-mentioned item “Technical result of health and accident insurance”. The comparable health and accident insurance result is positively impacted by changes in provisions by DKK 244 million.

The progress over the past years is due to three main factors.

Firstly, PFA continues to help more customers prevent and avoid long-term illness. During the first six months of the year, PFA’s health professionals conducted approximately 168,000 consultations with customers, which is slightly higher than the same period last year. At the same time, there has been a doubling of digital enquiries to PFA’s health insurance, from 25,800 to 50,900 claims in the first six months of the year. This increase is due to new and improved digital claims options and access to an online doctor, psychologist, physiotherapist and coach.

In the first six months of the year, PFA has supported approximately 92,000 children and adults with treatment programmes, representing a 23 per cent increase compared to the same period last year. The development is primarily driven by an increased need for support and advice regarding mental health issues or musculoskeletal injuries, as well as PFA’s strengthened proactive efforts to assist customers.

Secondly, PFA focuses on helping customers on long-term sick leave return to work. In the first six months of the year, 832 customers returned to the job market, which is over 5 per cent more than last year, when the figure was 789. Over the past two years, the number of reactivations has grown by 13 per cent.

Thirdly, insurance prices are becoming more balanced, and overall, these initiatives have delivered a significant financial impact and improvement in the result.

“Forst and foremost, we are saddened that the state of health in Denmark is challenged in many areas, as evidenced by the fact that many of our customers need our support in the health area. On the other hand, we are, of course, pleased and proud that we help so many people in Denmark with their health every day, making a difference for our customers and their families. That we can now also achieve this while bringing our financial results in the health and accident insurance area into balance is a major milestone for PFA, which we are satisfied to have reached as planned. However, maintaining this balance will require continued focus and effort,” says Ole Krogh.

PFA places great emphasis on continuously developing health solutions that meet customers’ needs and deliver strong results.

“We must continuously improve the support and solutions we provide to our customers, as the state of health in Denmark is unfortunately under pressure. This is where, in the short term, we can made the greatest difference for those of our customers who need help. Therefore, in 2025, we have also developed our health solutions for both companies and private individuals. For example, we can see how our digital well-being tool helps companies create better workplace well-being. By enhancing our digital solutions and leveraging artificial intelligence, we have made it much easier for our customers to access the right support. This means that our customers now receive help even faster and earlier, minimising the risk of symptoms developing into long-term illness. And if a customer is already on long-term sick leave, we can intervene more effectively and quickly, with the hope of helping the customer return to work, benefiting everyone,” says Ole Krogh.

PFA’s pension customers see positive returns despite a turbulent half-year

In the first six months of the year, a typical customer with 15 years to retirement in PFA’s recommended investment profile, PFA Medium, achieved a positive and competitive return of 2.1 per cent . This is positive during a half-year marked by trade wars, market volatility and a sharply declining dollar.

“Over the past three years, PFA’s customers have achieved some of the market’s best returns after costs, and we are very pleased with this as it provides financial security. We have sensibly managed our equity risk and successfully protected our customers against the sharp dollar decline, which otherwise eroded returns from US equities. We are pleased that we have guided our customers through a turbulent period, as it demonstrates that we have a robust investment strategy and risk management that also delivers competitive returns during financial market volatility. This is why we firmly believe that our investment strategy will continue to deliver attractive returns and financial security for our customers in the future,” says Ole Krogh and continues:

“The first six months of the year have once again proven that it pays to stay calm and remain true to one’s investment strategy and risk appetite. In April, the return for a typical customer was down to minus 9 per cent, and just a few months later, it turned positive. Therefore, it is gratifying to see that our customers have generally stuck to their investment profile. We still believe that pension customers will achieve positive investment returns this year, as the global economy is generally in good shape, and we can look forward to tailwind from falling interest rates and fiscal stimulus packages. That said, we must prepare for another round of turbulence, as the trade policy tug-of-war continues and there is significant geopolitical uncertainty,” says Ole Krogh.

PFA’s new investment profiles have made a strong start

European equities, in particular, have driven the returns in the first six months of the year. This equity growth is good news for PFA’s customers, as from 1 April, we began transitioning our customers into new investment profiles with a higher proportion of equities.

“We are pleased that our new investment profiles have had a strong start, and it is encouraging to see that during periods of equity growth, the new profiles are delivering the intended effect. This looks promising for the future, as, over the long term, equity markets tend to rise more than they fall. We expect our customers to benefit even more from this in the years to come,” says Ole Krogh.

PFA’s existing customers will be fully transitioned to the new profiles by 1 January 2026, while customers who joined after 1 January 2025 are already fully invested in the new profiles.

Top marks for customer satisfaction

High customer satisfaction is essential in a customer community like PFA. It is therefore highly gratifying that PFA has the most satisfied individual and corporate customers among commercial pension companies. This is reflected in the latest published surveys from EPSI and Aalund’s Corporate Pension Barometer.

“Our success depends on having satisfied customers who are happy to be part of our customer community. That is why we work diligently to deliver excellent customer experiences and maintain a strong reputation. We are therefore delighted and grateful to see from surveys and daily feedback that individual, corporate and organisational customers are highly satisfied,” says Ole Krogh.

For more information

Contact acting Head of Press Nis Refslund Poulsen, tel. (+45) 2763 6425, nrp@pfa.dk

Watch the video with Ole Krogh about the half-year financial report